Claims Payment Information

Enrollee Claim Submission

There is no reason for you to pay a provider for covered services under your Certificate (other than copayments, coinsurance and deductible), but if circumstances require that you do, and you can prove that you have, MHP Community will reimburse you for those covered services. You must provide written proof of the payment within 12 months of the date of service and complete a Direct Member Reimbursement Form. You can find the form below or you can obtain a copy by calling Customer Service at (888) 327-0671. Direct Member Reimbursements should be submitted to address on the form.

NOTE: The proof of payment documentation must include the procedure code, diagnosis code, charges, the amount you paid and the Provider Tax ID number. Claims submitted more than 12 months after the date of service will not be paid.

Direct Member Reimbursement Form

Commercial - Medication Exception Review Process

McLaren Health Plan (MHP) has placed a prior authorization (PA) restriction on certain medications within the formulary (covered medication list). PA means the medication requires special approval before it will be considered for coverage under MHP. A medication may require a PA due to safety concerns or to ensure a formulary alternative cannot be used. If you need a medication that requires PA, your prescribing provider will call us to begin the authorization process. If you don’t get the prior authorization, you may have to pay up to the full amount of the charges. The number to call for prior authorization is included on the ID card you receive after you enroll. The member or prescribing provider may request a Formulary Exception for a clinically appropriate non-formulary medication. The request must include a justification supporting the need for the non-formulary medication to treat the member’s condition, including a statement that all covered formulary medications on any tier will be or have been ineffective, would not be as effective as the Non-formulary medication, or would have adverse effects. IF THE PRIOR AUTHORIZATION PROCEDURES ARE NOT FOLLOWED, ramifications include withdrawal of the prior authorization request and non-coverage. MHP will make the determination on a standard formulary exception request and notify you or your authorized representative and the prescriber within 72 hours following receipt of the request. For expedited reviews due to exigent circumstances, MHP will make the determination and notify the member or member’s authorized representative and prescribing provider within 24 hours.

Drugs may be designated as non-formulary / non-covered, PA required, for several reasons, including, but not limited to:

- Coverage for the drug may not be a benefit.

- The drug may have been found to be ineffective in routine practice by the Quality Improvement Committee (QIC).

- Formulary alternatives may exist.

- The FDA may not have approved the drug.

PRIOR AUTHORIZATION APPLICATION PROCESS FOR MEMBERS OR PRESCRIBERS

- Step 1. The member or prescriber completes a Request for Prior Authorization which can be found by following the link: Pharmaceutical Request for Prior Authorization

- Step 2. The member or prescriber will then fax the completed form and all supporting documentation to:

MedImpact

Fax: (858) 790-7100

Prescribers may also call the MedImpact Help Desk: (888) 274-9689 (TTY dial 711) Hours: 24 hours a day, seven days a week to begin the process. The prescriber then submits the completed form and all supporting documentation to the PBM at the fax number above.

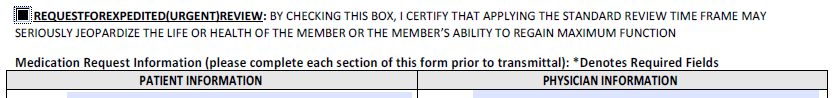

FOR EXPEDITED DRUG EXCEPTION REVIEW REQUESTS DUE TO EXIGENT CIRCUMSTANCES

- Step 1. The member or prescriber completes a Request for Prior Authorization which can be found by following the link: Pharmaceutical Request for Prior Authorization

- Step 2. The member or prescriber must select the REQUEST FOR EXPEDITED/URGENT REVIEW option on the request form.

- Step 3. The member or prescriber will then fax the completed form and all supporting documentation to:

MedImpact

Fax: (858) 790-7100

Prescribers may also call the MedImpact Help Desk: (888) 274-9689 (TTY dial 711) Hours: 24 hours a day, seven days a week to begin the process. The prescriber then submits the completed form and all supporting documentation to the PBM at the fax number above.

Internal Review Process

- Step 1. A pharmacist at the PBM will review the exception request for content and contact either MHP's CMO or authorized representative for review and benefit determination.

Approved: As directed by MHP, the PBM will enter an authorization (override) into the member’s electronic profile for the length of time approved by the health plan. Note: Once a medication is approved by MHP, the dispensing pharmacy will not need any special pre-certification/prior authorization number.

Pending: MHP is pending the request for more information. The PBM will contact the prescriber to request additional information. All Utilization Management time frames established by MHP will apply.

Denied: The Chief Medical Officer (CMO) or authorized representative has denied the request. The Utilization Management denial and appeals policies established by MHP apply to any pharmacy denial. If the drug is denied, you have the right to appeal.

Appeals: Internal Review Process

If you or your provider feels that MHP Community has denied the prior authorization request incorrectly, an appeal may be filed. If the original request was an expedited exception request, the plan will make coverage determination and notify the enrollee or the enrollee’s designee and the prescribing provider no later than 24 hours following receipt of the request and no later than 72 hours following receipt of the request if the original was a standard exception request.

To request an appeal with MHP Community's Appeals Committee, you or your authorized representative must send an appeal request in writing within 180 calendar days of MHP Community's resolution to your complaint/grievance or denial of services. Appeal request along with any additional information are to be sent to:

McLaren Health Plan Community

Attn: Member Appeals

G-3245 Beecher Road

Flint, Michigan 48532

If you wish to have someone else act as your authorized representative to file the appeal, you must complete MHP's Authorized Representative Form, or call Customer Service at (888) 327 0671 (TTY: 711) for a copy to be mailed to you.

Appeal: External Review Process

If we continue to deny the coverage or service requested, or you do not receive a timely decision, you have the right to an external review. If the original request was a standard exception request, the plan will make a coverage determination on the external exception request and notify the enrollee or the enrollee’s designee and the prescribing provider no later than 72 hours following receipt of the request and no later than 24 hours following receipt of the request, if the original request was an expedited exception request. The external review may be filed with the:

Department of Insurance and Financial Services Health Plan Division

Office of General Counsel – Appeals Section

P.O. Box 30220 Lansing, MI 48909-7720

FAX: (517) 241-4168

PHONE: 1-877-999-6442

Or submit the request online at: https://difs.state.mi.us/Complaints/ExternalReview.aspx

Grace Periods And Claims Pending Policies During The Grace Period

If you purchased an individual plan through the health insurance marketplace and you are receiving advance payments of tax credits in accordance with the Affordable Care Act, each of your monthly periodic payments is due on the first day of the month for that coverage period. There is a grace period of three months for all monthly premium payments after the initial premium payment.

If you fail to make a timely monthly payment while receiving advanced payments of the premium tax credit, you will be placed into a grace period of three consecutive months. During this grace period, McLaren will pay all appropriate claims for services rendered to you during the first month of the grace period. McLaren may put claims in the second and third months of the grace period under payment pending. During this timeframe, McLaren is required to notify the Office of Health and Human Services of your non-payment as well as notify providers that there is a possibility that claims may be denied in the second and third months of the grace period. Pending claims will be paid only once all periodic monthly payments due during the grace period are received. If you fail to pay in full all periodic monthly payments due and payable before the end of the grace period for the applicable coverage periods, your coverage under the plan will be retroactively canceled back to the last day of the first month of the grace period. Failure to timely pay premium payments is not a special open enrollment event for later coverage under the plan.

*Grace period: a period of time beyond a due date during which a financial obligation may be met without penalty or cancellation.

Retroactive Denials

A retroactive denial is the reversal of a previously paid claim. If the claim is denied, the Member becomes responsible for payment. Retroactive denial of claims can be avoided by paying premiums on time.

Recoupment Of Overpayments

If you believe you have overpaid your premium due to our overbilling, please contact us by calling Finance Department at (810) 733-9528.

Coordination Of Benefits (COB)

Coordination of Benefits or COB means determining which Certificate or policy is responsible for paying Benefits for Covered services first (primary carrier) when a member has dual coverage. Benefit payments are coordinated between the two carriers to provide 100% coverage whenever possible for services Covered in whole or in part under either plan, but not to pay in excess of 100% of the total amounts to which providers or Members are entitled. Except as otherwise stated in this Certificate, MHP Community will coordinate benefits in accordance with Michigan law, and specifically PA 275 of 2016; MCL 550.251, et seq.

If the carriers that issued plans cannot agree on the order of benefits within 30 days after the carriers have received all of the information needed to pay the claim, the carriers shall immediately pay the claim in equal shares and determine their relative liabilities following payment. A carrier is not required to pay more than it would have paid had the plan it issued been the primary plan.

Coordination of Benefits Form

Failure To Pay Initial Premium

Whether you purchase your MHP Community individual coverage on or off the Michigan Marketplace, your enrollment is not complete until you have paid your first month’s premium. This is referred to as your “Initial Premium”. It must be paid directly to MHP Community – not to the Michigan Marketplace. This payment must be paid no later than 30 calendar days from the intended effective date of coverage in order for your coverage to begin.

You will usually not have a payment coupon booklet before your Initial Premium is due, so please do one of the following:

- Call Customer Service at (888) 327-0671 for instructions on how to pay your Initial Premium;

- Hand deliver your Initial Premium to the McLaren Health Plan Community office at G-3245 Beecher Road, Flint, Michigan; or

- Mail your Initial Premium to P.O.Box 771983, Detroit, MI 48277-1983

If we do not receive your payment within the 30-day time period your coverage will not be effective.

Termination Of Coverage

TERMINATION FOR NONPAYMENT OF PREMIUM

If the Subscriber fails to pay any premium other than the Initial Premium – whether in whole or in part, by the due date - the contract is in default.

A. MEMBERS WHO RECEIVE ADVANCED PREMIUM TAX CREDITS (APTC):

If you purchased your Coverage on the Michigan Marketplace and receive APTC and you have paid at least one full month of premium during the current benefit year, you will be given a three (3) month grace period during which the premiums must be brought up to date. If you need health care services at any time during the second and third months of the grace period, MHP Community will hold payment for claims beginning on the first day of the second month of the grace period and notify the Participating Provider that we are not paying these claims during this time. If premiums are not brought up to date within the three month grace period, your Coverage will be cancelled. Your last day of Coverage will be the last day of the first month of the three-month grace period. All claims for any health services that were provided after the last day of Coverage will be denied, and any Benefits incurred by a Member and paid by MHP Community after the Termination effective date may be charged to the Subscriber or the Member who received the Benefit.

B. MEMBERS WHO DO NOT RECEIVE ADVANCED PREMIUM TAX CREDITS (APTC):

If you purchased your Coverage on or off the Michigan Marketplace, you do not receive APTC and you have paid at least one full month of premium during the current benefit year, a grace period of 31 days will be granted for the payment of each premium falling due after the first premium, during which grace period the policy shall continue in force. If premiums are not brought up to date within the one month grace period, your Coverage will be cancelled. Your last day of Coverage will be the last day of the last month in which a full monthly premium was received by MHP Community. All claims for any health services that were provided after the last day of Coverage will be denied, and any Benefits incurred by a Member and paid by MHP Community after the Termination effective date may be charged to the Subscriber or the Member who received the Benefit.

C. TERMINATION OR NON-RENEWAL OF A MEMBER’S COVERAGE – ADDITIONAL CAUSES

Coverage for a Member may also be Terminated or Non-Renewed for any of the reasons listed below. Such Termination or MHP Community’s decision to Non-Renew Coverage is subject to thirty days’ notice (including the reason for the Termination or Non-Renewal) and, if applicable, grievance rights, and is effective on the date specified by MHP Community or the Michigan Marketplace.

- The Member enrolled in a Michigan Marketplace plan is no longer eligible for Coverage through the Michigan Marketplace;

- The Member enrolledwith MHP Community off the Michigan Marketplace no longer meets MHP Community eligibility requirements;

- The MHP Community Michigan Marketplace plan is terminated or decertified by state or federal regulators;

- The MHP Community plan is withdrawn from the marketplace by MHP Community in accordance with state and federal laws;

- A contract is cancelled for nonpayment of premium;

- The Member changes products;

- The Member moves out of the MHP Community Service Area;

- The Member enrolled with MHP Community off the Michigan Marketplace ceases to be a member of an association through which the Member has achieved eligibility; or

- The Member commits fraud against MHP Community or a provider of Benefits.

A Member wishing to Terminate Coverage must provide at least fourteen (14) days’ notice to MHP Community or the Michigan Marketplace (as applicable) of his or her wish to Terminate.

D. RESCISSION OF MEMBER’S COVERAGE

Rescission of Coverage means the Member’s Coverage ends retroactive to the date a Member committed fraud against MHP Community or a provider of Benefits, or intentionally misstated or intentionally withheld a material fact. MHP Community will provide at least 30 days’ notice of a rescission. A Member may appeal a Rescission of Coverage by following the MHP Community Complaint and Appeals Procedure. Fraud or intentional misstatement or withholding of a material fact includes:

- Intentional misrepresentation of the eligibility of a Member;

- Fraudulent use of the MHP Community ID card; or

- Fraudulent use of the MHP Community system.

NOTE: Any amounts paid by MHP Community after the event are due and owing from the Member.

For retroactive denials, recoupment of overpayments and/or any other information regarding claims, please contact Customer Service at (888) 327-0671.

Out-Of-Network Provider And Balance Billing

An out-of-network provider or facility does not have a contract with MHP Community. They are paid at a reasonable and customary rate.* The out-of-network provider or facility can charge you the difference between what their total charged amount is and what MHP Community paid. This is called “balance billing.” Your deductible and coinsurance may be higher when you see an out-of-network provider.

*HMO Plan members only have out-of-network coverage for urgent and emergent care. All other out-of-network services are not covered unless preauthorized by MHP Community.

Enrollee Responsibilities And Medical Necessity

At the time of enrollment and if requested by MHP Community thereafter, Members are required to disclose to MHP Community whether they have health coverage under any other certificate or policy. Members must also immediately notify MHP Community if there are any changes in such coverage. If a member fails to provide such information when requested, or to notify MHP Community upon any changes to the Member’s other health coverage, MHP Community may deny payment for individual claims.

Members have the right to request and ask for and be given, without cost, a copy of the actual benefit provisions, guidelines, protocol, clinical review criteria or other information used to determine Medial Necessity, All requests must be sent in writing to MHP Community Customer Service, G-3245 Beecher Road, Flint, MI 48532.

Some procedures, tests, or supplies require a review to determine medical necessity. Prior authorization for these procedures, tests, or supplies must be obtained prior to obtaining the service. A list of procedures, tests, and supplies that require prior authorization is available here on our website.

Prior authorization requests are processed within 14 days of receipt for non-urgent requests, and between 24-72 hours for urgent needs.

Explanation Of Benefits (EOB)

MHP Community does send you an Explanation of Benefits (EOB) that details the amount of charges for health care services you have received, the amount we paid, the amount we denied and any copay, coinsurance or deductible you may owe. If a bill from your provider does not match the information on your EOB, you can either call Customer Service at (888) 327-0671, TTY 711, for an explanation of the charge, or you can call your provider. EOBs are generated and mailed after we adjudicate the claim.

Explanation of Benefits Sample